Investing in LoanBillboard

LoanBillboard provides a totally new service for personal and small business loans based on a new form of marketing called “Reverse Marketing”.

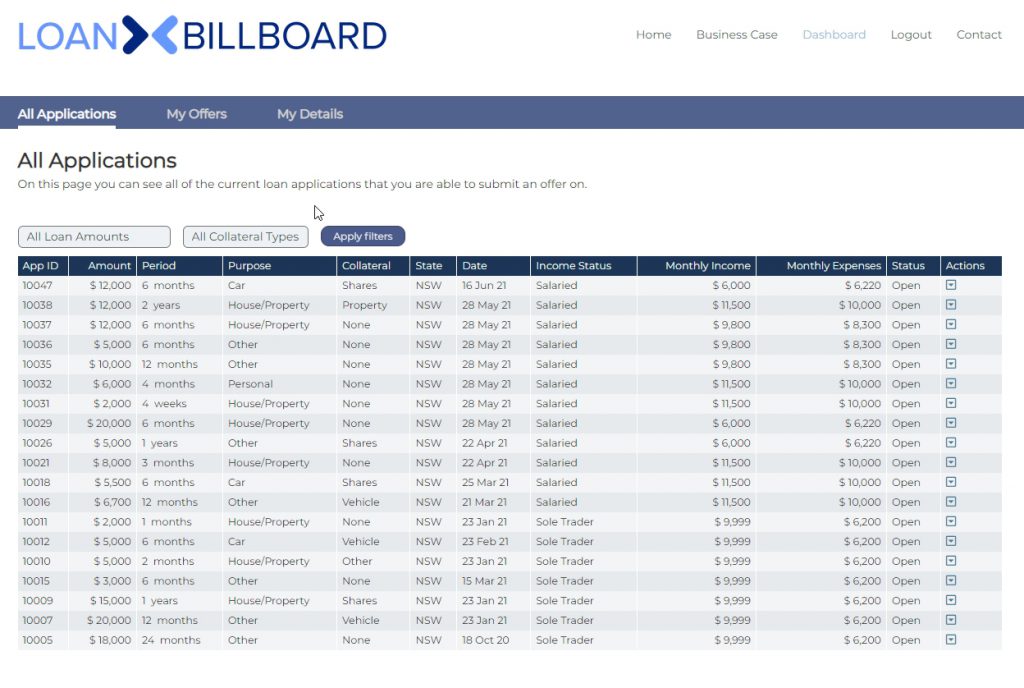

LoanBillboard uses a unique way of originating personal loans for banks and personal loan borrowers. It allows borrowers to post their loan requirements onto a Loan Billboard which is a public listing of all borrowers (particulars de-identified) and their current borrowing requirements. Banks and non-bank lending companies can then subscribe to LoanBillboard and can select the borrowers that they want to make loan offers to.

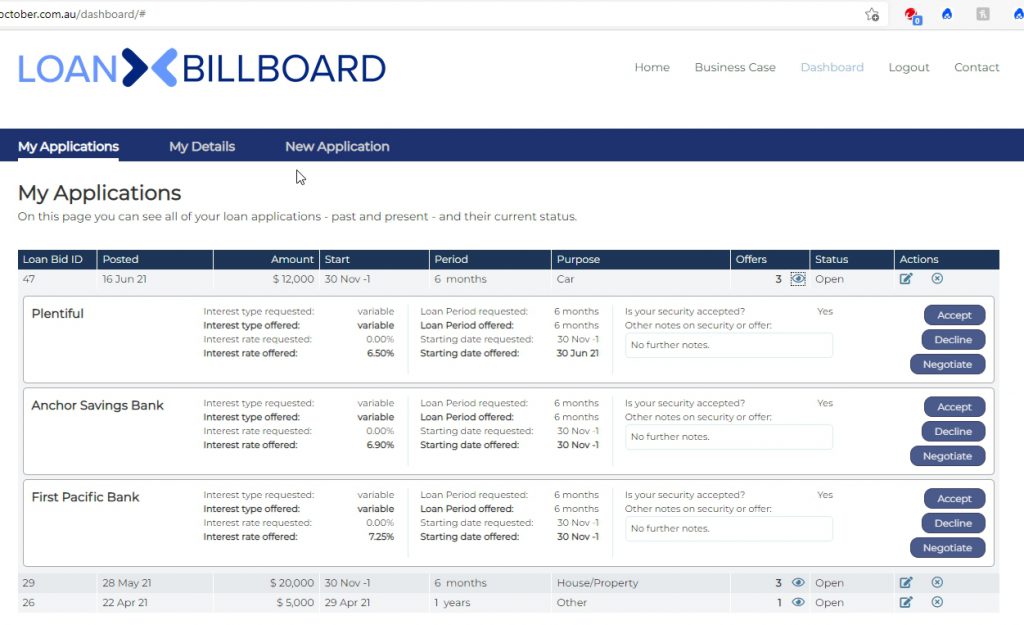

A borrower may receive multiple offers for their loan requirements and is able to negotiate directly with the bank or lender for the best interest rate for the loan based on their higher credit rating and any collateral being offered for the loan.

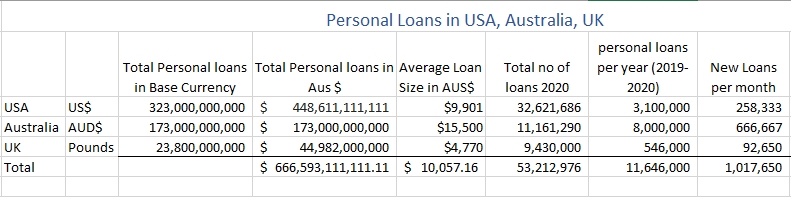

The Opportunity: The personal and small business loan markets in Australia, UK and the US together are massive (see table on the left). With only a small penetration (such as 5%) of the overall personal loan markets the financial returns for this service would make it highly profitable.

Current scenario: Currently when a member of the public needs a loan, they can find banks and lenders on the Internet and select which lender has the best deal by comparing the interest rates, comparison rates and repayment terms.

Entering a loan application today: Today, it is up to the borrower to go out and find the loans from various banks and lenders and to then fill in multiple loan application forms online, each one subtly different, and all usually lengthy affairs. Currently, there is no room for negotiation even if the borrower is otherwise a highly attractive credit proposition for the bank or lender or has collateral with which to secure the loan.

Pressure to lend capital: Retail banks make the bulk of their earnings by taking deposits at one interest rate and lending at a higher interest rate, and then lending the same amount multiple times over (usually 3 to 5 times the actual deposit amounts). Banks and lenders themselves are under pressure to lend as much funds as possible but are limited to only borrowers who have selected them on a loan comparison website or gone to their website and entered in a full loan application for them. We can call this “Push Marketing” where the bank is pushing loans out of the door in response to their advertising and marketing.

LoanBillboard is “Reverse Marketing”: What LoanBillboard does, is to turn the process around and make the Banks and Lenders instead respond to the borrower’s individual loan requirements. This is done by allowing the borrower to upload their requirements for a loan onto a purpose designed website, “LoanBillboard”, and then giving the banks and lenders access to the pool of borrowers currently looking for a loan (see menu item Application above).

Putting the power in the borrower’s hands: The system puts the business control back into the customer’s hands by firstly letting them put their loan requirements on the LoanBillboard – the borrower is now in control.

Other features that allow the borrower more control: When customers input the Loan Requirements, they can put the terms they want for the loan including the maximum interest rate they are willing to pay. This is a negotiation tactic for the borrower that makes the lenders aware of the user’s realistic tolerance before they make an offer. LoanBillboard has a “negotiation engine” which allows the borrower and lender to negotiate the key terms of the loan back-and-forth including interest rate, term, collateral and so on. When both parties agree on all the terms they can finalize the loan – a loan which makes sense to both sides.

Disrupting the loan markets: In banks’ lending to corporates and large institutions there has been a tendency for banks to be as flexible as possible in their terms, including tailoring cash-flows, collateral and other terms to suit the borrower – all in order to get and keep the business. In times gone by it was impossible to broadcast your loan requirements for a personal loan to multiple banks and lenders at the same time – other than ringing around each by phone or email. With LoanBillboard and the Internet, all that has changed, and now the borrower and customer can now be the new “deal mover”.

Wider audience for borrowers: With LoanBillboard borrowers will have a wider audience for their loan requirements and will be seen by many more banks than they would if they had entered their details in a loan comparison site or gone directly to the bank’s or lender’s website. Even the largest loan comparison websites will only field the borrower’s loan requirements to a few hundred banks and lenders in the loan comparison site’s “network”. Now, with LoanBillboard these requirements can be seen by many banks or lenders in their state, out of their state or even internationally. In the future we could see a loan in New York being originated by a LoanBillboard subscriber in Dubai or Singapore.

Generic Single Loan Application: The borrower only has to enter in their loan application details once in the LoanBillboard system – a Single Loan Application or SLA. The questions for this will capture enough data to see whether a bank or lender is interested in making an offer to them or not (the bank or lender will be able to ask additional questions to the SLA whilst making the final offer). This avoids the inconvenience of the borrower having to fill in multiple lengthy applications for each bank or lender, and perhaps getting knocked back by many or perhaps all of them. This is the bane of getting a personal or small business loan today.

Sub-prime borrowers: Up to 76% of loan applications on loan comparison sites or direct to the bank or lender are rejected. This may be for nothing more than the borrower has not applied for a loan before or currently has no credit history. Only 35% of the ones which are accepted go on to be successfully originated. This a huge problem with the current environments.

No rejections: With LoanBillboard they can now be reached by banks and lenders globally who can negotiate out any shortcomings in their financial profile by altering the interest rate or securing the loan with collateral. With LoanBillboard the borrower is never rejected outright.

Why will the borrowers use it? The success of LoanBillboard depends on a number of separate questions. Firstly, will the borrowers use the site to canvas for loan offers? The Loan Billboard’s justification to the borrower is “Input your loan application once and then instead of hunting for loans, let the banks and lenders come to you!”.

Target Users: Borrowers may turn to LoanBillboard for the following reasons:

- they have been rejected by all the lenders on the loan comparison site due to a no or low credit score or other reason Note: 76% of all Personal Loan Applications to loan comparison sites are rejected as “sub-prime borrowers”*.

- Loan Comparison sites can show a button linked to LoanBillboard for all applicants who have been rejected for a personal loan in the Loan Comparison Sites.

- they are “early adopters” who are used to trying out new websites and services.

- they may be wanting to get the very best interest rate possible, by putting out their loan requirements to many different banks and lenders at the same time, via LoanBillboard, and then receiving back multiple competing loan offers from them.

- because they should get better loan terms than generally available via loan comparison sites because:

- they have an especially good credit history or have an unusually high credit score

- they can offer collateral as security (such as their vehicle or house) for the loan

- they can “negotiate-out” their loan details and requirements directly with a bank or lender

Why will the banks use it? Will the banks and lenders want to look at, and respond to, the LoanBillboard database of current borrowers? The usual cycle for Banks and Lenders is to advertise their services and rates and then “wait for the phone to ring”. With LoanBillboard however they can go to a place where there is already a pool of borrowers in the market for loans, without relying solely on their advertising or word of mouth. With LoanBillboard they can also negotiate their interest rates by fine-tuning them for an otherwise very eligible borrower (e.g. one with a high credit score) or for one that is willing to give collateral for the loan (which is the norm with small business or corporate loans).

When a Bank’s Relationship manager Geoffrey B., a relationship manager from a large Australian Bank, was asked recently whether he would use such as system if it were available, he responded “You bet! We would use anything to get more loan deals! …I cannot believe someone hasn’t done this before”.

* https://au.finance.yahoo.com/news/reason-people-get-rejected-personal-loan-184003098.html

“One Size Fits all”: The “one size fits all” for borrowers is now changed to the Bank/lender being able to gradually “custom fit” the loan based on the profile of the borrower on the LoanBillboard Billboard. Loan applications usually are met with just a “yes” or a “no”. However, in the LoanBillboard system the bank or lender may be able to be more flexible in fitting their loan terms by negotiating a loan deal i.e., by adjusting their interest rate, repayment terms or taking on collateral (note taking collateral is the norm with corporate and small business loans).

How will LoanBillboard make money? LoanBillboard has two income streams. Firstly, it charges the bank or lender 100 basis points (1%) for each loan originated through LoanBillboard. Secondly it charges banks to access the billboard via a LoanBillboard terminal at $890 per month ($10,680 per annum).

A future for loans: The vision of the LoanBillboard system is to disrupt the traditional consumer lending market by creating a new, more transparent loan exchange where borrowers can go and find loans with flexible, customised terms at more competitive rates. The Internet by its nature is putting the power back into the consumer’s hands by opening the channels communication globally and creating a more transparent and efficient marketplace.

To summarise:

- No other site like it on the Internet for personal and small business loans

- Proven business model

- Massive target markets

- Makes money from day one

- Capacity to grow into a billion-dollar business